SALES of new-crop Australian wheat are ticking over ahead of a shipment program which looks set to start in November.

China, Indonesia, Malaysia, The Philippines and Vietnam are all believed to have booked new-crop cargoes of Australian wheat for shipment up to February.

Low basis, which reflects the premium for Australian wheat over United States wheat futures, is a marketing plus, while China’s intention to increase inspection, testing and document verification of Australian wheat and barley imports is the market’s largest concern. The news from the General Administration of Customs of China (GACC) came via a 1 September notification on its website.

Low basis, which reflects the premium for Australian wheat over United States wheat futures, is a marketing plus, while China’s intention to increase inspection, testing and document verification of Australian wheat and barley imports is the market’s largest concern. The news from the General Administration of Customs of China (GACC) came via a 1 September notification on its website.

Amid tensions between the Australian and Chinese governments, exporters are hoping that wheat does not join barley in being excluded from volume sales to China.

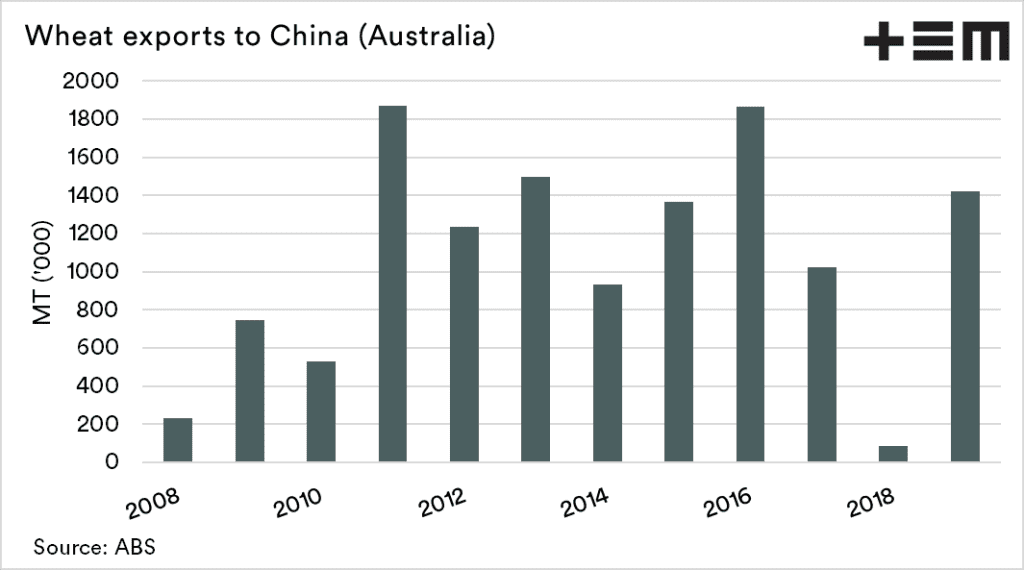

For what it’s worth, Australia’s track record appears to be supportive.

“Despite the notice identifying wheat, the Department of Agriculture, Water and the Environment has not received any formal non-compliance notifications for Australian wheat from China in over two years,” a spokesperson for the Australian Government department said.

“The department is aware of this notice and continues to hold regular teleconferences with major grain exporters and industry to keep them abreast of the latest market-access issues.”

Market prospects

Sources have said up to 1.5 million tonnes (Mt) of new-crop wheat may have been sold at basis levels of around AU$12-$15 per tonne over Chicago December wheat, which is competitive with Black Sea wheat now being shipped to Asia.

In its latest monthly supply-and-demand report for wheat issued 2 September, Lachstock Consulting said the market was saying up to 1Mt of wheat may have already been booked to Vietnam.

Increased Chinese demand

“That being said, during the same period, we were responsible for an average of 39pc of Chinese imports.”

Source: Thomas Elder Markets

Barley has consistently accounted for the bulk of Australian grain exports to China, with some years also seeing significant volumes of canola, sorghum and pulses as well as wheat shipped.

Basis hard to call

If the Australian dollar strengthens considerably, or if spring goes against the forecast and turns hot and dry, basis is likely to jump.

If basis stays put, more export sales are likely as harvest, already under way in parts of Queensland, ramps up.

“Basis CBOT-20 is about AU$12-15/t over, which is $10 higher than the season low, with the rally in our relative pricing coming from both a rise in global FOB values, and the dry spell we’ve seen domestically over the past 4-6 weeks.”

“Pending rainfall forecast for the weekend, this is threatening to take the shine off what looks like a great winter crop.’

“When we look at basis, it’s important to look at Aussie wheat basis both versus the US futures but also the Black Sea/MATIF market, as they are our biggest competition when it comes to exporting.

“When we look at our basis Black Sea for example, we are as weak as we’ve been for some time, highlighting both the cheap relative pricing of our wheat but also the recent surge in global export markets, which is helping support our prices.”

Mr Crundall said where basis will go between here and January is hard to pick.

“A lot comes down to the quality of our crop, but also what market we’re looking at.

“Basis CBOT can definitely appreciate, given the CBOT market is so inflated versus the rest of the world prices, so a basis rally may come from a fall in CBOT’s relative pricing.

“Outside of some short-term risk, our relative pricing is very supported around current levels”

Mr Crundall said a rally in Australian basis may come from a lack of adequate grower selling, especially if we see global and futures markets fall, and growers prove unwilling to sell at lower numbers.

Quality issues caused by wet weather or an excessively dry finish, or an export program hefty enough in the front end to bring a lot of demand to the market, could push prices higher.

“Looking further out, basis looks very attractive, and a good risk/reward proposition to hold into the post-harvest market as our relative downside is limited considering how cheap we are versus our export competitors.”

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY