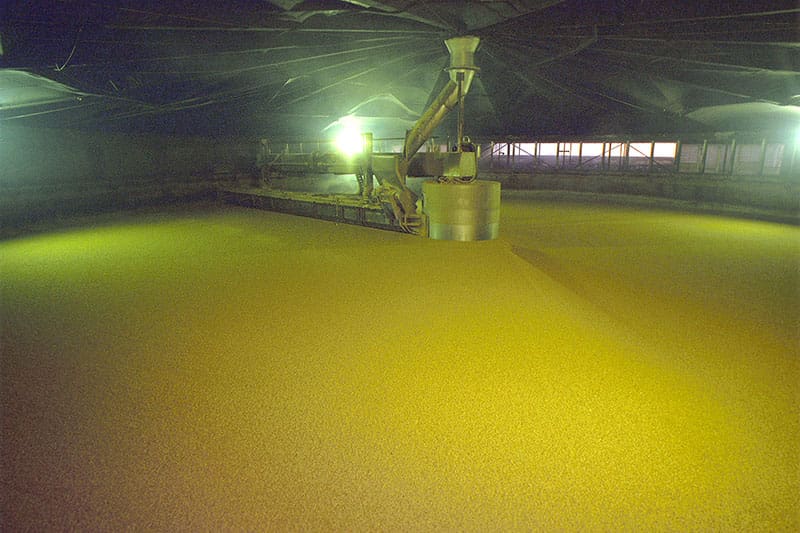

Kilning of barley in an Australian malthouse. Photo: United Malt Group/Barrett Burston

THE NEWS that China has imposed a tariff of 80 per cent on Australian barley has hit the industry hard, but the market may be able to find a partial solution by value-adding the grain at Australian plants and exporting the malt.

While Australian maltsters have limited surplus capacity, exports of malt instead of malting barley could supply roughly 10 per cent of the demand from Chinese breweries, and save them from having to rejig their production to accommodate malt from barley from other origins.

Grain Central understands global demand for malt has eased as a result of COVID-19, which has freed up some capacity at Australia’s big industrial malting plants.

“I understand the maltsters have reduced demand through their assets, and I’d imagine they are trying to find a way around that now,” Cory Johnston senior grain trader Justin Fay said.

“They’re not going to be able to take the 3.5 million tonnes (Mt) of malting barley Australia would normally send to China, but they could take some.”

China’s tariff on Australian barley has come into effect this week and is expected to last for five years.

“Extending beyond that, if we have demand from China for our malt, and we’re looking at a five-year proposition, there could even be some increase in capacity in Australia.”

Mr Fay said malting varieties like Planet and Spartacus were sought by maltsters in China as well as Australia, and exports of Australian malt could keep consistent quality flowing through the supply chain.

“If you put yourselves in the shoes of a Chinese brewer, they might be willing to pay tariff.”

Grain Central understands some Chinese maltsters may be prepared to pay the tariff on Australian barley because of the efficiencies it represents in terms of faster batch times.

Australia’s malting capacity converts up to 1.2Mt per annum of barley to more than 1Mt of malt.

The domestic market consumes around 20pc of production, and the balance is shipped in bulk and containers to export markets.

Australian maltings are owned by:

- Axéréal’s Boortmalt, which has a combined annual capacity in Australia of 550,000t spread across plants in Devonport in Tasmania, Minto near Sydney, Perth, Port Adelaide, and Ballarat;

- Malteurop has Australian production capacity of 200,000t, all at its plant at Geelong in Victoria;

- United Malt Group produces 250,000t in total at its Brisbane, Geelong and Perth plants; and,

- Coopers Brewery in Adelaide produces 54,000t of malt annually. Boutique operations like Voyager Malt produce small additional tonnages.

Canola, wheat sail along

China last year became a bulk customer for Australian canola, largely as a result of China and Canada falling out when Canada detained a Huawei executive.

The latest Australian Bureau of Statistics export data indicates China was Australia’s second-biggest canola export customer in the six months ended 30 March, taking 310,204t, behind only Germany on 363,699t.

On its website, the Canola Council of Canada (CCC) said Canada had been shipping about 30pc of normal canola seed exports to China since March 2019, and indicated its level of shipments was likely to continue in the near term.

“Canola shipments to China remain blocked as the licenses of two large exporters, Richardson and Viterra, to export canola seed to China remain suspended,” CCC said.

Canada’s loss appears to be Australia’s gain in the Chinese canola market, where demand has increased as a result of the COVID-19 lockdown.

It has prompted an increase in home cooking with canola oil to compensate for decreased use of palm oil in commercial kitchens.

However, a change in the Canadian-Chinese trade relationship could see China withdraw its interest in Australian canola.

Australia’s wheat trade to China may be a steadier proposition.

In the six months to 30 March, China was Australia’s second-biggest bulk wheat market behind The Philippines, taking 648,116t after purchasing zero bulk Australian wheat in the six months to 30 March 2019.

“In the past 10 to 20 years, China’s had an appetite for a more western-type diet, and they want higher-protein and higher-quality wheat for that,” Mr Fay said.

Canada and the United States have also been bulk suppliers of wheat to China, but Canada’s share of the Chinese wheat market last year increased at the expense of the US due to its troubled relationship with China.

And to highlight the uncertainties inherent in global trade, China last week announced it had opened its doors to US barley.

“It’s a lesson for all of us in terms of diversification.”

Grain Central contacted Boortmalt, Malteurop and UMG for comment on potential malt exports to China, but none have responded ahead of the publication deadline.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

What a sensible and clever approach. Malt the barley, save shipping cost most of all Add Value.

A few brains loose in Australia