THE Australian barley industry should diversify its markets while continuing to engage with Chinese brewers and maltsters, according to a new Australian Export Grains Innovation Centre (AEGIC) report.

Entitled ‘Barley 2030: Anticipated trends in global barley consumption’, it summarises important barley markets for Australia and makes recommendations to maximise value for the industry.

AEGIC’s barley markets manager Mary Raynes said it was important for Australian barley growers to have access to a diversity of markets to reduce reliance on a single dominant buyer.

In recent years that has been China which in May imposed a hefty tariff on Australian feed and malting barley.

“We are recommending that the Australian industry, supported by government, should identify alternative market opportunities,” Ms Raynes said.

“This will involve detailed market analysis, including the value and volume of opportunity, the suitability of Australian barley for key end uses in malt and feed, and any market access constraints.”

Some potential and current market opportunities for Australian barley include India, Vietnam, Saudi Arabia, Japan, South Korea, South East Asia and the Middle East/North Africa.

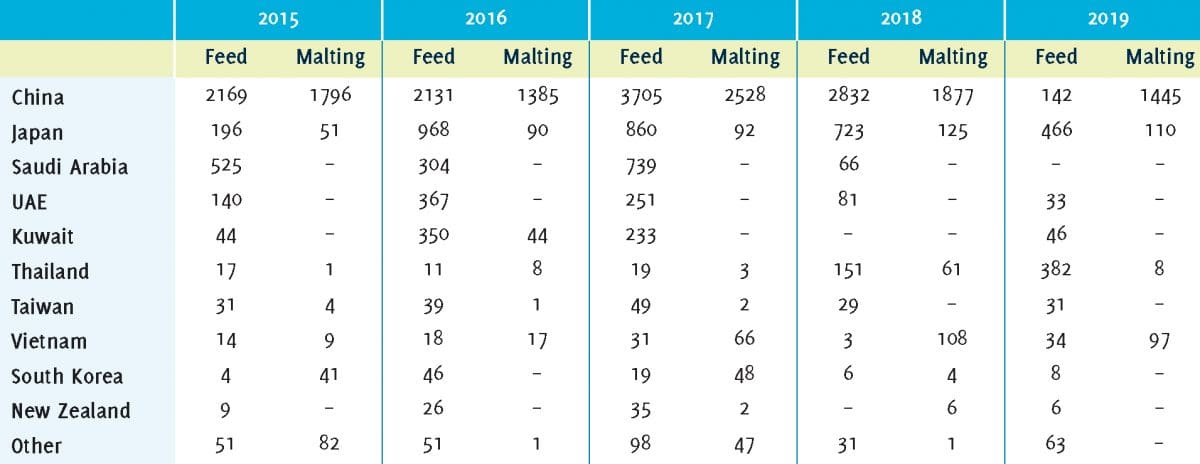

Table 1: Australian barley exports by destination. Source: Australian Bureau of Statistics

Chinese connection important

Ms Raynes said it was important for Australia to stay connected with Chinese maltsters and brewers, despite the current tariffs.

“China is by far the largest importer of malting barley globally and will remain so towards 2030,” she said.

“There are strong mutual benefits to continued engagement with China.”

Ms Raynes said China would be more likely to resume buying of Australian barley when tariffs lifted if it remained informed about the malting and brewing quality aspects of new Australian varieties, and research and market developments.

“The Australian industry will also remain mindful of the needs of Chinese brewers and maltsters when making breeding and classification decisions.”

Ms Raynes said Australia would need to maintain and grow its presence in important malting markets outside China, most notably India and Vietnam.

“The industry should focus on regular, positive engagement with these markets, and others, to make sure Australian barley is meeting their needs.

“An improved understanding of potential new barley uses could also benefit the Australian industry.”

This included high beta glucan barley for human health and combination food uses such as barley/rice mixes.

The report also recommends Australia develop and communicate targeted information about the benefits of Australian barley for animal feed to a range of markets.

“Some success with this strategy has been seen in increasing feed volumes to Thailand in recent years.”

Indonesia has not been a significant importer of Australia barley, but the IA-CEPA provides an opportunity to use barley as an alternative feed grain in Indonesia’s growing poultry industry.

Barley loses global ground

Barley stands out amongst the major world cereals by having limited production growth over the past 20 years.

Total global barley production has remained flat and the total area harvested has declined by more than 10pc.

In contrast, total grain and oilseed production has increased steadily over the past 20 years and in 2015-19 was 43pc higher than in 2000–2004.

Increased corn production over this period has made a large contribution to total grain and oilseed growth, with production increasing by more than 70pc.

Corn area has increased by nearly 40pc and total trade has doubled.

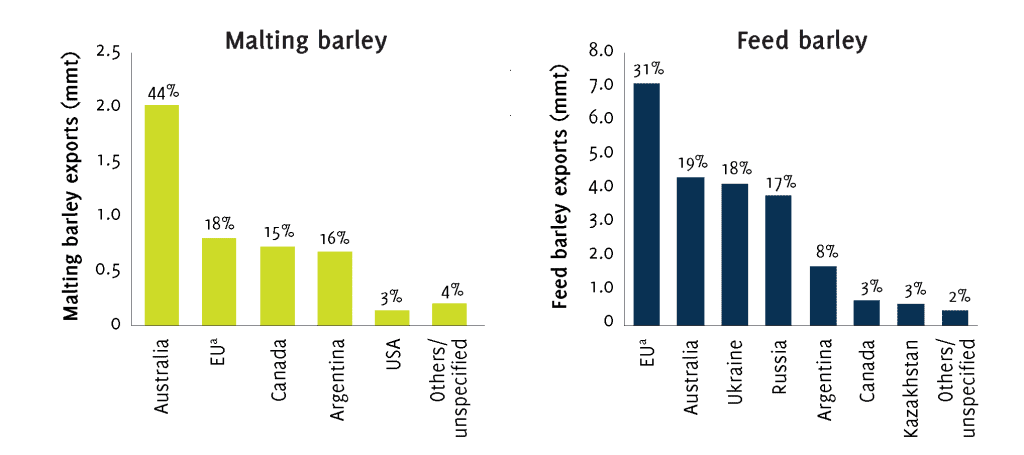

Figure 1: Average annual malting and feed barley exports by country, averaged from 2013-14 to 2016-17, with EU comprising 28 nations including Croatia. Excludes intra-trade. General-purpose barley may sometimes be classified as feed or malting (e.g. Fair Average Quality (FAQ)) barley exported from Australia to China. Source: International Grains Council

Trade increases

Despite flat production, barley trade has increased substantially.

Barley trade is nearly 70pc higher in 2015–2019 compared with 2000-2004.

However, even this impressive increase was less than the increase in total global grain and oilseeds trade, and so barley’s proportion of world trade has shrunk.

Over the same period, barley exports from Australia increased by 30pc, but Australia’s share of global trade in barley declined.

Despite an overall decline in market share of total barley exports, Australia remains the largest malting-barley exporter, accounting for more than 40pc of global exports.

Australia exports double the amount of feed barley as it does malting barley, and Australia accounts for about 20pc of total feed barley exports.

Barley production and export markets are more important in Australia than in the other barley-exporting countries, and the importance of exports has increased over the past 20 years, particularly in Western Australia.

From 2000-2004 barley represented about 20pc of total grain and oilseed production in Australia, somewhat similar to most other barley-exporting countries.

From 2015 to 2019, barley as a proportion of total grain and oilseed production in Australia increased to 25pc, but it has decreased in most other exporting countries.

Market roundup

China

Once tariffs are reduced or eliminated, Australia will face increased pressure for a share of the Chinese malting market from Canada, Ukraine, Argentina and potentially Russia, as their volumes of barley available for export grow.

China will remain the dominant market for malting barley, with imports expected to remain at current levels within the range of 2-3 million tonnes (Mt) per annum.

Over the next decade Chinese barley imports may increase by up to 2.1Mt, but the increase will be mostly feed barley, highly variable, and strongly affected by government policies directed at other feed grains, particularly corn.

China has emerged as an important malt exported since 2007.

The EU dominates malt exports, while Brazil is the largest malt importer, and Asia the dominant malt-importing region.

Exports from China continue to grow and compete with Australian malt exports to Asia.

Unlike other major exporters, malt in China is mainly produced from imported malting barley.

Japan

Japan has imported consistent quantities of malting and feed barley, with malting barley being used mostly for food.

Demand for malt in Japan is unlikely to change substantially from current demands over the next decade, with falling per-capita alcohol consumption to be countered to some degree by a change in tax law that will make full-malt beer more affordable.

Intense competition among Japanese breweries in the stagnant market is driving innovation in the sector to make more effective use of lower-cost ingredients.

This may provide opportunities for Australian and other cheaper-origin malts to gain market share at the expense of higher-priced Canadian alternatives.

Increasing health-consciousness is a robust and durable trend in Japan.

Australia’s export grains sector could position itself to gain advantage from this trend.

An example is the growing health interest in barley beta-glucan for its health benefits.

Japan’s requirement for a small amount of barley for specialised shochu manufacture will continue to provide a high-value opportunity.

Australia’s historic position of holding a high market share in Japan’s feed barley imports will need to be supported through high quality and competitive pricing against EU and Black Sea competitors.

India

India is likely to continue to produce barley that is better suited to feed rather than malting use.

India’s downward trend in barley production is likely to continue, necessitating increased imports of malting barley.

Beer will capture an increasing market share over time as consumers move away from higher alcohol beverages like spirits to lower alcohol beverages like beer.

By 2030 India is likely to import 450,000-650,000t of malting barley, with the Australian industry well positioned to supply a significant share of the imports.

Saudi Arabia

The Saudi Arabian government continues it endeavours to increase the use of domestically processed compound feed instead of imported raw barley.

However, there remains a degree of resistance to this change, particularly among politically influential Bedouin producers who have maintained the historical practice of feeding unprocessed barley to their livestock.

Saudi Arabia is the only market capable of utilising the volume of Australian barley displaced by Chinese tariffs at current levels.

South Korea

Towards 2030, South Korea provides more opportunity for Australian exports of malt than malting barley, but limited growth in Korean beer consumption constrains market prospects.

Opportunities for Australian feed barley in the South Korean feed market are likely to remain limited.

South Korean feed manufacturers favour wheat over barley as a cereal feed.

Vietnam

Vietnam’s beer production will increase by 2-3pc per annum to 2030, which will continue to create strong demand for imported malt and malting barley.

A forecast increase of Vietnam’s malting capacity towards 2030 will see malting barley imports increase to about 330,000t, nearly double the 2019 figure.

Malt imports will be needed to supplement domestic malt production as it adjusts to keep pace with rising demand.

Smaller opportunities may exist for feed barley, but this will be opportunistic and dependent on its price relative to corn as the major feed ingredient.

Diversifying uses

Towards 2030, AEGIC said the availability of large parcels of malting barley varieties with a varying quality profile range including fermentability, malt extract, diastatic power and wort viscosity will be required to meet domestic and international requirements.

Australian barley is currently valued in a wide range of markets, often for different reasons. These include:

- diversity of barley offerings through malting, Fair Average Quality and feed segregations that suit different markets and functionalities;

- a protein range that allows incorporation into a range of brewing streams;

- an excellent safety record supported by strong regulation;

- clean, bright and dry grain with low myco-toxicity that improves food or feed safety;

- Australia’s efficient and reliable supply pathways; and

- an emerging phenomenon of barley in the health-food market with products including BARLEYmax, a high-fibre wholegrain with high levels of resistant starch.

Source: AEGIC

HAVE YOUR SAY