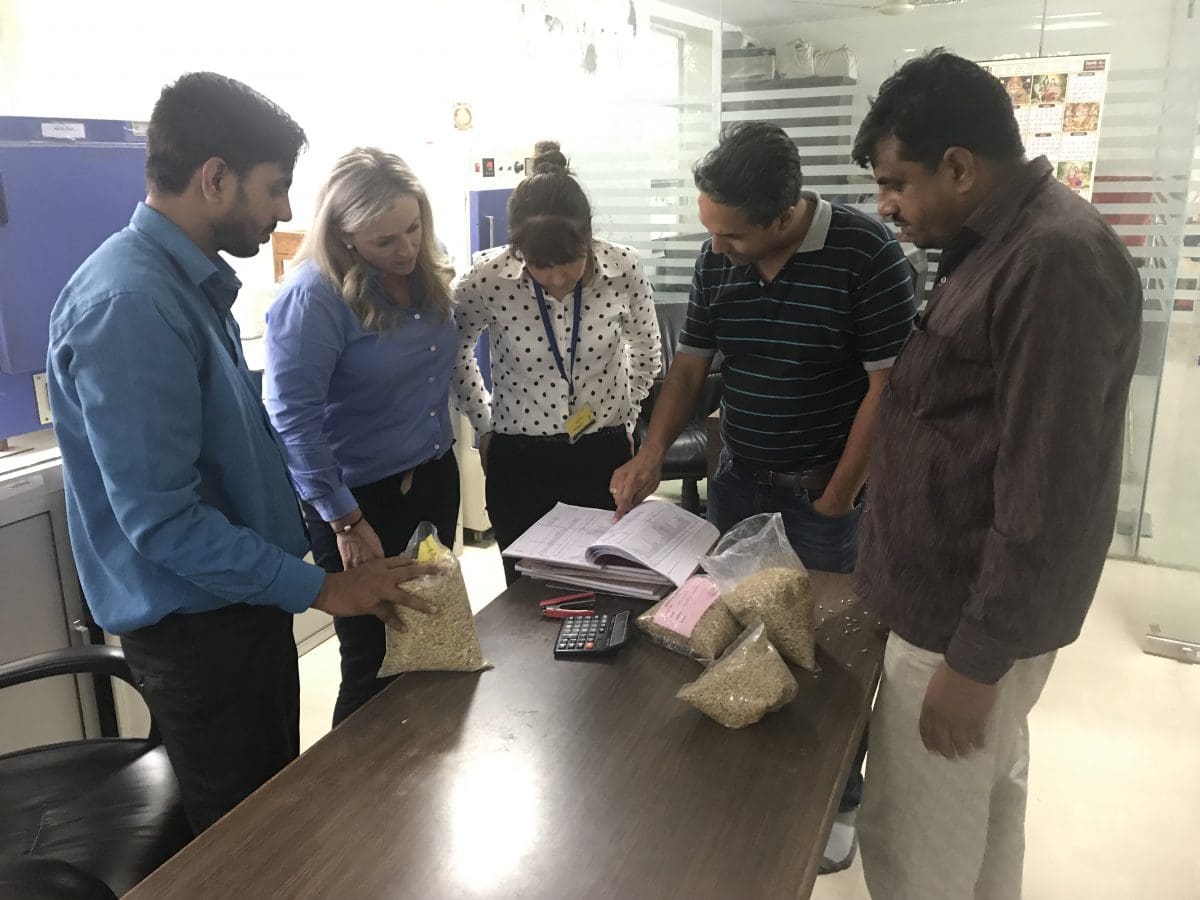

Padmavati Agrico malthouse owner and general manager Yogesh Jane runs through some lab results with AEGIC’s Mary Raynes and Barley Australia executive chair Megan Sheehy. Photo: AEGIC/Austrade

A STRENGTHENING strategic relationship between India and Australia is being looked to with hope by Australia’s barley industry as it seeks out emerging markets for malting.

India has been a volume buyer of Australian barley in the past, but has not purchased significant tonnages since 2006-2009.

India’s list of prohibited weed seeds, which includes ryegrass and wild radish which can occur in barley crops, remains the only barrier to reopening the trade.

If the Comprehensive Strategic Partnership (CSP) India and Australia committed to earlier this month can help to deliver a minimal instead of a zero tolerance for ryegrass and wild radish, exporters are hopeful India could be in the market for Australian malting barley as early as next year.

This follows India’s announcement earlier this year that it would accept Australian malting barley that has been fumigated with phosphine at a rate within Australia’s permitted usage rates.

Previously, India had required all fumigation to be methyl bromide, which is not suitable for malting barley because it denatures the seed and impacts the malting process.

Keen demand

Working with Australia’s Departments of Agriculture and of Foreign Affairs and Trade (DFAT) and their Indian counterparts, the Australian Export Grains Innovation Centre (AEGIC) has been spearheading the industry push to reopen India to Australian malting barley.

Padmavati Agrico owner and managing director Yogesh Jain inside the company’s malthouse in Rajasthan. Photo: AEGIC/Austrade

AEGIC barley technical markets manager Mary Raynes last year visited India to meet with its malting and brewing industry and government officials, and said Indian maltsters were keen to buy Australian barley.

“The market’s not going to take the 2-3 million tonnes (Mt) a year that China was taking, but we know India like our quality,” she said.

“The relationship between Australia and India is very genuine, but it will all come down to price.”

Argentinian FAQ barley is currently supplying most of India’s import requirement, which kicks in after the domestic crop typically harvested in March and April is exhausted.

Some Russian barley, as well as Esterel and RGT Planet barley from France, has also been imported by Indian maltsters.

Kenya and Ukraine are also shaping up as suppliers.

“The Australian Government is working with the Indian Government on the weed seed list across all grains,” Ms Raynes said.

“If there’s a resolution to the weed seeds issue, India and Australia will be trading.

“If the quality and the price is right, you’d expect enthusiastic discussions.”

Partnership progress

According to DFAT, India was Australia’s eighth-largest trading partner and fifth-largest export market in 2018-19, with coal and education being the leading goods and services.

Following a virtual summit on 4 June involving Australian Prime Minister Scott Morrison and Indian Prime Minister Narendra Modi, the two countries have entered into a Comprehensive Strategic Partnership (CSP).

“India is committed to further intensifying comprehensive relations with Australia,” Prime Minister Modi told his Australian counterpart during the summit.

“This is important not only for our two nations, but is also needed for the Indo-Pacific region as well as for the world.”

Mr Modi said he was not satisfied with the speed and scope of Australian-Indian relations.

“The benchmark for the speed in all of our relations should be ambitious.”

Prime Minister Morrison said he thought the CSP would take Australia and India to “a whole new level of relationship” and described the areas covered as forming “a grand portfolio”.

It is believed to include cyber systems, defence, education, infrastructure, investment, science, and trade.

“The trade and investment flows between our countries are not where you and I would both like them to be, but they are growing and they can grow a lot faster,” Morrison said.

Difficulty for agriculture

India has 1.39 billion people, making it the world’s second most populated country behind China.

Their incomes are affected by the Indian Government’s setting of a Minimum Support Price (MSP), which subsidises 150 million farmers.

In tandem with tariffs that prevent imports from reducing the value of India’s domestic grains and pulses, MSPs have hit Australian chickpea and lentil exporters hard by closing India which is historically Australia’s biggest market for both pulses.

Tempering this is some short-term relief from a lowered tariff on lentils.

“There is so much commercial risk in India because they are protectionists,” one industry source said.

India grows 600,000-800,000 hectares per annum of barley each year which produces around 1.5-1.7Mt.

The barley area has stabilised in the past year or two following 10 years of contraction, which reflects its lower MSP than oats and wheat.

AEGIC’s market research said India could experience a further decrease in barley production as farmers switched to crops which get higher MSPs from the Indian Government.

Coupled with the low MSP, decreasing groundwater tables, urban sprawl pushing grain production into less fertile soils, increased electricity costs and limited availability of electricity to power pumps used for irrigation could all further impact India’s barley area.

The challenge for the Australian barley industry has been to convince Indian maltsters that while its offering may cost more per tonne, its superior malting characteristics make it better value than its competitors and than Indian barley.

Expansion of India’s malting capacity is unlikely due to the high cost of capital investment, including the need for back-up generators needed during India’s frequent power outages.

About India’s malting market:

- India has a malting capacity of about 500,000t per annum;

- Roughly 80 per cent of the barley India grows is consumed as feed, and the rest is malted;

- India has around 200,000 million beer drinkers, and produces 2.3 billion litres of beer per annum;

- Multinational brewers including Asahi, ABInBev, Carlsberg and Heineken hold more than 90pc of India’s beer market.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY