There is strong demand for plant-based protein ingredients made in Australian from locally-grown pulses. Photo: Unigrain

MAJOR developments towards increasing the production of plant-protein ingredients made from pulses in Australia have slowed with proposed fractionation facilities in South Australia, Victoria and Western Australia yet to start manufacturing at a commercial scale.

This comes as the demand from local manufacturers to buy Australian-grown and processed products continues to expand.

In Australia, there is currently only one operational pulse fractionation plant capable of producing materials which can be manufactured into plant-based foods, such as patties, mince, strips and dairy alternatives.

This facility, located at Horsham and owned via a joint venture of Australian Plant Proteins and Bunge, currently produces protein isolates from faba beans, lentils, mungbeans, yellow peas and chickpeas.

Several Australian manufacturers, such as v2food and Harvest B, use an extrusion process to produce ingredients from soy and wheat.

However, extrusion cannot transform other pulses into isolates that can then be used in consumer products.

v2food’s high profile founder Nick Hazell has recently stepped out of the CEO role after holding the position for four years.

Despite rumours that the company’s key production facility in Wodonga is not moving ahead with a possible expansion or production ramp up, the plant appears to be operating as usual.

Labels emerge as fractionation lags

APP and other companies are working towards increasing the Australian pulse fractionation output, but none have currently achieved any major increase in production.

Baiada has launched a range of pea-protein products under the brand Greens & Goodness. Photo: Greens & Goodness

These delays come as new and existing brands look to manufacture plant-protein products in Australia, all of which would use ingredients – such as isolates – as part of the production process.

Recent announcements include poultry heavyweight Baiada, which since 2021 has launched a line of pea-based protein products; and Cale and Daughters, in collaboration with Israel’s Vgarden, which is building a factory in Darra, Queensland, to make plant-based meat and dairy alternatives.

Australian alternative proteins think tank Food Frontier believes there is a strong demand for local processing, which could create more demand for pulse crops.

“There is enormous opportunity for the Australian plant-based food industry to use locally grown protein ingredients, with consumer preference for locally grown ingredients and sustainability considerations of manufacturers key drivers of this demand,” Food Frontier head of industry engagement Susie O’Neill said.

“Currently Australia has minimal domestic plant-protein fractionation capacity to process locally grown pulse and cereal grains onshore, a bottleneck that is forcing manufacturers to either source already processed plant proteins grown in other markets, or re-import locally grown plant proteins that have been fractionated in overseas facilities.

“As domestic fractionation capacity increases, Food Frontier predicts this will create new revenue streams for farmers to add value to pulse crops and relieve supply chain pressures for Australian plant-based food manufacturers.”

APP founders Brendan McKeegan and Phil McFarlane. Photo: Food Frontier

SA facility held up

There was Australian-wide interest when a consortium of APP, meat processor Thomas Foods International and the Australian Milling Group announced in March 2022 that SA would be home to three new plant protein manufacturing facilities.

The total project was estimated to cost about $378M.

Alongside the consortium’s funds, the SA Government had pledged $65M and the Federal Government’s Modern Manufacturing Initiative (MMI) grants program will contribute $113M.

Almost a year later, there has been little movement with the project.

There were fears an inquiry into the previous Federal Government’s grant administration, announced in October, may result in the funding being withdrawn.

However, the current Federal Government has confirmed it has agreed to fund all MMI grants, and that negotiations were progressing to finalise funding contracts.

Shadow Minister for Industry, Skills and Training Sussan Ley said the delays were “holding back business and putting jobs at risk”.

“This is seriously concerning, given the impact these commitments have for hundreds of workers, countless communities and for investment certainty for our country, in what is an incredibly competitive and fast-moving global market,” Ms Ley told The Australian last month.

APP founder and director Brendan McKeegan said the consortium hopes to “move as quickly as we can” to progress the project.

“We are just finalising paperwork…and each of the individual entities are doing their own design in preparation for finalising those agreements,” Mr McKeegan said.

“It is still all on track…and we will start it as soon as we can.”

TFI said it also remains committed to expanding into the plant-based protein space.

“We continue to actively work alongside our consortium partners and Government to progress the proposed industry initiative,” a TFI spokesperson said.

Mr McKeegan said APP was also working through the design phase to add a second line to their existing production facility in Horsham.

This would take the company’s protein isolate production from 1500t to 6000t per annum.

Unigrain’s new facility will process pulses into a range of ingredients, such as flours, starches and protein powders. Photo: Unigrain

“We are very excited about the opportunities ahead of us.”

Unigrain site nears completion

Family-owned company Unigrain is expected to open Australian next next pulse fractionation facility.

The company was founded in the 1970s, and in mid-2021 announced plans to build a facility at its current Smeaton site, north of Ballarat.

The plant will initially use 40,000t of locally grown field peas and faba beans per annum to process into plant-based food ingredients.

Last year, Unigrain launched a new product range of pulse-protein powders, starches and flours in preparation for the opening of the new facility.

The facility was initially earmarked to open in mid-2022, which was pushed back to late 2022, and it is now expected to be commissioned in the near future.

Unigrain co-CEO Andrew May said the project faced several challenges posed by global COVID-19 lockdowns and delays getting access to materials and equipment.

He said the business is “nearing the end of the process” and hopes the facility should be commissioned soon.

Mr May said, in the interim, the business is in discussions with potential customers.

“We are very confident of how the market will evolve once production commences,” Mr May said.

“We have been engaging with customers for a number of years, so we are pretty clear what will happen once we have started production.

“The market indications are very clear which is the market wants to move from imported protein to domestic production.”

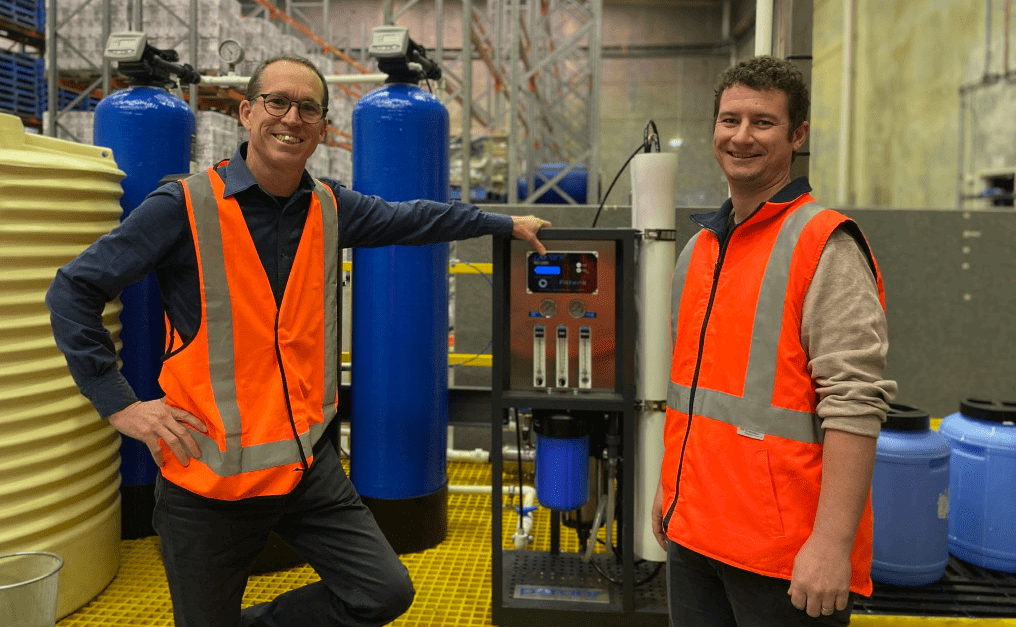

WOA executive director Ben Cole and operations manager Brad Dack in the lupin protein pilot plant. Photo: WOA

WOA goal for commercial production

Western Australian company Wide Open Agriculture is working on a different offering compared to its eastern state competitors.

In mid-2022 company opened a pilot plant manufacturing a plant-based protein product from sweet lupins.

The material, named Buntine Protein, can then be used in a range of meat and dairy alternatives.

Currently output is at a “pilot level” with WOA expecting to expand annual production to 30-50t during the fiscal year, according to the company’s quarterly results report released in January.

WOA CEO Jay Albany said the company has made progress with owners off existing ‘brownfield’ sites which could be modified to manufacture commercial quantities of Buntine Protein.

“At the end of last year, in December, Ben Cole and I went and visited a number of sites and a number of large prospects,” Mr Albany said.

“We are in final negotiations with a potential partner that we’ve identified as the best fit, a partner which we do have high hopes for an offtake agreement, as well, and we’ll update the market as soon as possible.”

He said the potential site would have the initial capacity to produce 10,000t of Buntine Protein per annum and could accommodate future expansion.

Food company Monde Nissin Australia has a supply agreement with WOA to purchase up to 60pc of the total production of the pilot facility over a two-year period.

Mr Albany said the demand for the product is expected to grow in the coming months.

“For the next two quarters, to the end of the fiscal year ending June 30th, we expect multiple new offtakes to be signed for Buntine Protein at commercial scale.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY